What the Real Estate Industry Needs to Know Before March 1, 2026

The real estate industry is preparing for a major compliance shift with the introduction of a new Anti-Money Laundering (AML) reporting rule from Financial Crimes Enforcement Network. To help navigate what’s coming, we’ve broken down the most common questions and explained what this rule means, who it impacts, and how to stay compliant.

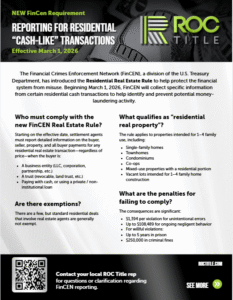

What Is FinCEN?

FinCEN is a bureau within the U.S. Department of the Treasury charged with safeguarding the financial system from illegal activity. Its role includes enforcing the Bank Secrecy Act and identifying patterns related to money laundering, fraud, and other financial crimes by collecting and analyzing transaction data.

In short, FinCEN’s mission is to follow the money and stop bad actors from using the U.S. financial system to hide illicit funds.

What Is the New FinCEN AML Rule?

Starting March 1, 2026, FinCEN will require reporting for certain residential real estate transfers involving legal entities or trusts when the transaction is non-financed.

This rule applies more broadly than many expect:

- “Residential real property” is not limited to single-family homes

- “Non-financed” does not mean only all-cash deals

Reports must be submitted to FinCEN by the later of:

- The last day of the month following the month of closing, or

- 30 calendar days after the closing date

Key Takeaways at a Glance

- Designed to curb money laundering and related financial crimes

- Applies nationwide with no county exemptions

- Covers non-financed transactions beyond just cash purchases

- Introduces new reporting and record-retention obligations

- Failure to comply may result in civil or criminal penalties

How Is This Different From Geographic Targeting Orders (GTOs)?

Since 2016, FinCEN’s Geographic Targeting Orders have required reporting in specific high-risk markets and were temporary by nature. Those orders focused on limited locations and dollar thresholds.

The new AML rule is different in several critical ways:

- It is permanent, not temporary

- It applies to every county in the U.S.

- There is no minimum dollar amount, including gift transfers

- It captures a wider range of residential property types

This marks a significant expansion of reporting requirements and will impact far more transactions than GTOs ever did.

Who Will Be Most Affected?

The rule primarily impacts:

- Title insurance companies

- Title and settlement agents

- Closing and escrow professionals

Real estate agents will also need a working understanding of the rule to properly guide clients, while legal entities and trusts involved in property transfers must be aware of new disclosure and compliance responsibilities.

Training, system updates, and revised workflows will be essential ahead of implementation.

What Counts as Residential Real Property?

Under the rule, residential real property includes more than just a house:

- One-to-four unit residential properties

- Vacant land intended for future residential development

- Condos and apartments designed for 1–4 family occupancy

- Cooperative housing shares

What Is a Legal Entity Transferee?

A legal entity transferee is any non-individual buyer that is not a trust, including:

- Corporations

- Partnerships

- Estates

- Associations

- Limited liability companies (LLCs)

Common Exempt Entities Include:

- Publicly traded companies

- Government agencies

- Banks and credit unions

- Insurance companies and licensed producers

- Registered investment companies

- Broker-dealers and certain regulated financial entities

- Subsidiaries of exempt organizations

How Are Trusts Treated Under the Rule?

A transferee trust exists when assets are held by a trustee for beneficiaries or a specific purpose. Even if the property is titled in the trustee’s name, it is still treated as a trust for reporting purposes.

Trusts Commonly Exempt From Reporting:

- Estate planning trusts funded by an individual (or spouses) with no consideration

- Trusts where securities reporting issuers act as trustees

- Certain statutory trusts

- Subsidiaries of exempt trusts

What Is Considered a Non-Financed Transfer?

A transaction is non-financed if:

- There is no loan secured by the property, or

- Financing comes from a lender not regulated under BSA/AML/SAR rules

Examples include:

- All-cash purchases

- Seller carryback financing

- Private or hard-money lending

If the lender is not subject to federal AML regulations, the transfer is treated as non-financed.

What Information Must Be Reported?

For reportable transactions, the filing must include:

- The reporting party (often the title or settlement agent)

- The legal entity or trust acquiring the property

- Beneficial owners holding 25% or more ownership

- Trust beneficiary information, when applicable

- Individuals signing on behalf of the transferee

- Seller information

- Property details

- Transaction terms, including consideration and payment sources

Reporting Deadlines

A Real Estate Report must be filed by the later of:

- The last day of the month following closing, or

- 30 days after the closing date

What Does “Reasonable Reliance” Mean?

Reporting parties may rely on information provided by others unless there is reason to question its accuracy. However, beneficial ownership information:

- Must be provided directly by the transferee or their representative

- Must be certified in writing

Trust—but verify.

Who Is Responsible for Filing?

FinCEN uses a Reporting Cascade, meaning only one party is responsible for filing. Responsibility falls to the highest-ranking applicable party, such as:

- The settlement or closing agent

- The party preparing the settlement statement

- The party recording transfer documents

- The title insurer issuing the owner’s policy

- The party disbursing the largest amount of funds

- The party evaluating title status

- The party preparing the deed or transfer instrument

What Are Designation Agreements?

Designation agreements allow one eligible party in the reporting cascade to delegate filing duties to another qualified party.

Important points:

- Each transaction requires a separate written agreement

- Liability for compliance transfers with the designation

- Only parties within the reporting cascade may be designated

- Third-party vendors may assist with filing, but liability remains

Are There Transactions That Are Exempt?

Yes. Common exemptions include transfers involving:

- Easements

- Death or estate administration

- Divorce

- Bankruptcy estates

- Court-supervised transfers

- Certain no-consideration trust transfers

- Qualified intermediaries in 1031 exchanges

- Transactions with no defined reporting party

Penalties for Non-Compliance

Civil penalties may include:

- Fines ranging from approximately $1,400 to over $108,000 per violation

- Each day of non-compliance counts as a separate violation

Criminal penalties for willful violations may include:

- Up to $250,000 in fines

- Up to five years in prison

Click is here more Information

What If Multiple Entities Are Involved?

Each legal entity or trust receiving an ownership interest must be evaluated independently. Reporting may be required for more than one transferee in a single transaction.

Will FinCEN Audit Transactions?

Yes. FinCEN has authority to audit transactions and request supporting documentation. Records, including reasonable reliance documentation, must be retained for at least five years.

Are Commercial Transactions Ever Covered?

They can be. Even though the rule focuses on residential real property, certain commercial-style transactions still qualify, such as:

- Vacant land zoned for residential use

- Multi-family properties intended for residential occupancy

- Builders purchasing residential lots

- Mixed-use properties with residential units

The FinCEN AML Rule represents a major expansion of real estate reporting requirements. With nationwide reach, broader definitions, and strict penalties, preparation is essential. Understanding who must report, what qualifies, and how to document compliance will be critical well before the March 2026 effective date. Have questions? Reach out to your ROC Title Rep.